Over the past year we’ve heard plenty about increasing inflation and certainly felt the pressure of increasing costs as well. We’ve also seen in the news the Reserve Bank’s attempt to curb inflation with six Official Cash Rate increases since May 2022 rising from 2.00% to 5.25%. This has driven the Banks to increase their lending rates from record lows, to a very challenging current setting, with now best in market 1 year fixed rates nearing 7% p.a.

But all that may have you wondering, what does it really mean for my actual mortgage repayments? Especially if you have a fixed rate expiring, are looking at refinancing or are considering purchasing property soon.

Understanding the potential impacts of increasing interest rates on your mortgage repayments and subsequently your household budget, will help you get prepared now. It will also help you to make an informed decision about any changes you may wish to make to your mortgage going forward.

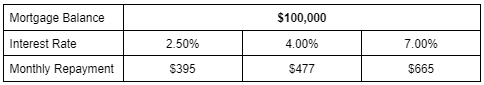

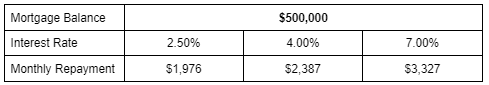

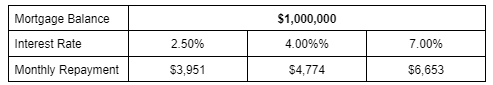

The tables below show the approximate monthly mortgage repayment on a 30 year term.

So, for example, if a borrower has a $500,000 mortgage with a 4.00% interest rate, their monthly repayments would be around $2,387. If interest rates increase to 7.00%, their monthly repayments would increase to around $3,327. Or, if a borrower has a $1,000,000 mortgage with a 4.00% interest rate, their monthly repayments would be around $4,774. If interest rates increase to 7.00%, their monthly repayments would increase to around $6,653.

Feel free to jump onto our Mortgage Calculator, to see how your new repayments could look, alongside your potential new rates – see latest banks rate here (source interest.co.nz).

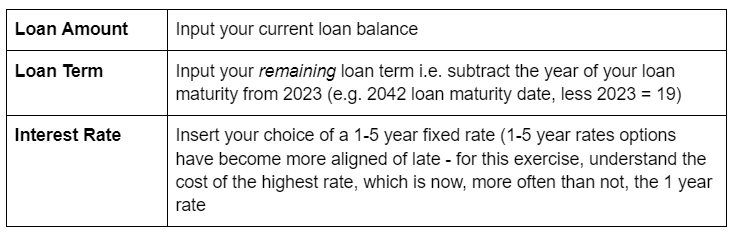

Here are our tips for how to calculate your approximate repayments using our Mortgage Calculator:

Tip # 1: When trying to work out what your approximate repayments may look like, following a fixed rate change, insert the following variables via our Mortgage Calculator:

Tip # 2: Bank Economists are generally projecting 1 more OCR rise, to 5.50%, which may push floating and 1 year rates higher still. Longer term fixed rates (less than 2 years) are widely expected to not go higher, and generally now have a future negative bias (source: Westpac Weekly Commentary).

So how can a Haven Mortgage Adviser help?

If you’re worried about paying higher interest rates on your mortgage, a Haven Mortgage Adviser can help you take control of the situation. By quickly reviewing your current and impending financial position and assessing your general affordability profile, all whilst possessing a comprehensive view of the wider market. Amidst all these variables, our team can make recommendations about how you can best manage your mortgage.

Whether through a restructure, refinance or refix there are options to help you get through rising repayments. Contact a Haven Mortgage Adviser today, to take control of your home loan and your budget!